Bartley Barstools has an equity multiplier of 2.4. The company's assets are financed with some combination of long-term debt and common equity. What is the company's debt ratio?is the company s debt

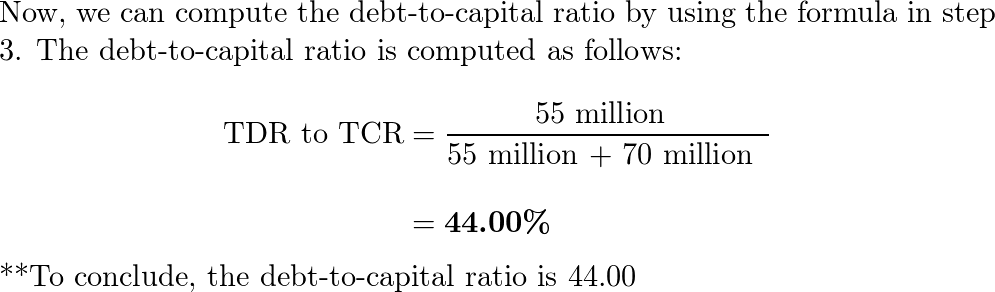

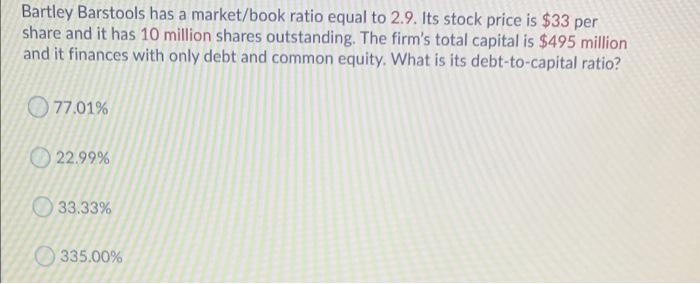

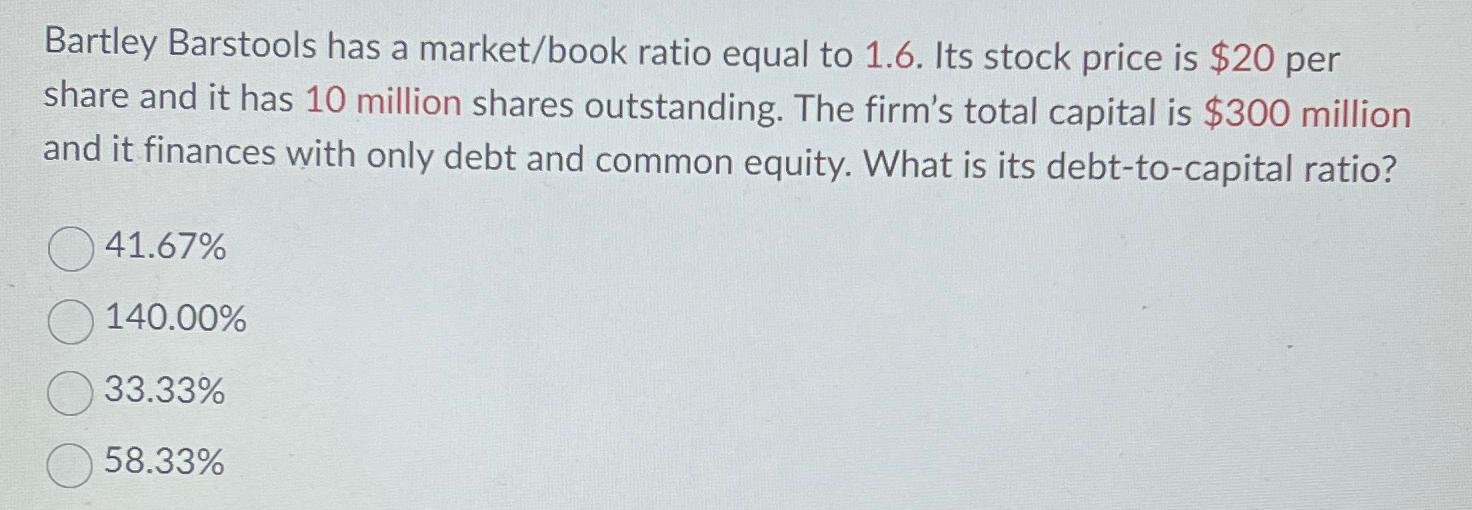

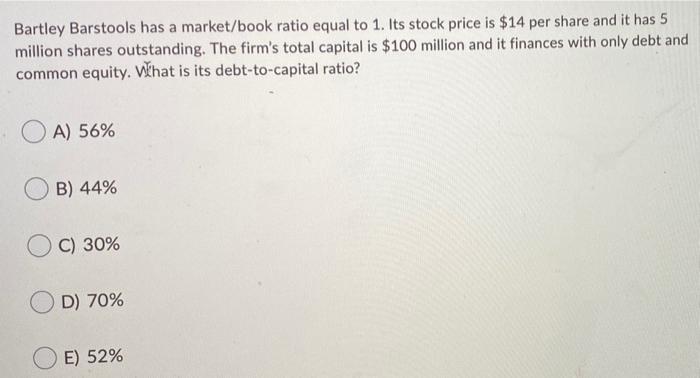

SOLVED: Bartley barstools has a market/book ratio equal to 1. Its stock price is 14 per share, and it has 5 million shares outstanding. The firm's total capital is125 million, and it

Amazon.com: The Barstool MBA: Why Running a Bar Beats Running to Business School (Audible Audio Edition): Dan Maccarone, Bob Sullivan, Dan Maccarone, Bob Sullivan, Audible Originals: Books